Following the Money - Part Five A: What's coming in for 2025

The ins and outs of our money

If you’ve been reading the series “following the money” you’ll have a general idea of where our money comes from. I thought it might be interesting for some of you to get in on the beginning of the public process for setting the 2025 budget. I know, snore right? But bear with me, because this affects your life daily. I’ll try to keep it simple. (Is that laughter I hear?). I’m using city graphics where I can.

Our City Charter requires City Administrator Kady Doelling to prepare a balanced budget including potential fee and rate increases, with assistance from department heads. She presented the recommended budget to the city council at their workshop on August 26. Our Chief Financial Officer Devin Billingsley is no longer with the city. Luckily the process starts early as you can see below and Administrator Doelling’s background is budget-oriented.

Let’s jump into the report and look at some of the forecasts for 2025 starting with the projected revenue. I'll write a second piece on the spendy part of the budget.

Keep in mind this is a recommended budget, it will go through a few more steps before adoption at a public hearing during a future council meeting.

THE 2025 BUDGET

THE PROCESS

2025 BUDGET PRIORITIES FROM THE STAFF MEMO

1. Sustaining What We’ve Built – Ensure financial sustainability of the investments the City has made in the past several years.

2. Classification and Compensation – Continue the implementation of findings from the Classification and Compensation study.

Karensplainer: Administrator Doelling launched this study. She is analyzing our staff positions and considering restructuring some of our departments. She is also digging in on staff salaries to ensure they are appropriate, too low and we can’t compete with other communities for skilled staff members. However, our staff benefits package is always talked about in positive terms.

3. Capital Needs – Begin addressing and planning for high-cost capital improvements.

Karensplainer: We have a long and costly list of infrastructure needs to run the city. More to come on that later. But last year in this post I quoted from a staff memo that said we have $290 million in capital assets, ranging from buildings and land to utilities and transportation needs. They need repairs, replacement, and general maintenance.

4. Strategic Plans – Continue implementing recently approved strategic plans.

Karensplainer: over the last few years several new plans have been created including the Climate Action Plan, Multimodal Transportation Plan, and Wildlife Plan. These plans will take, you guessed it, money to implement.

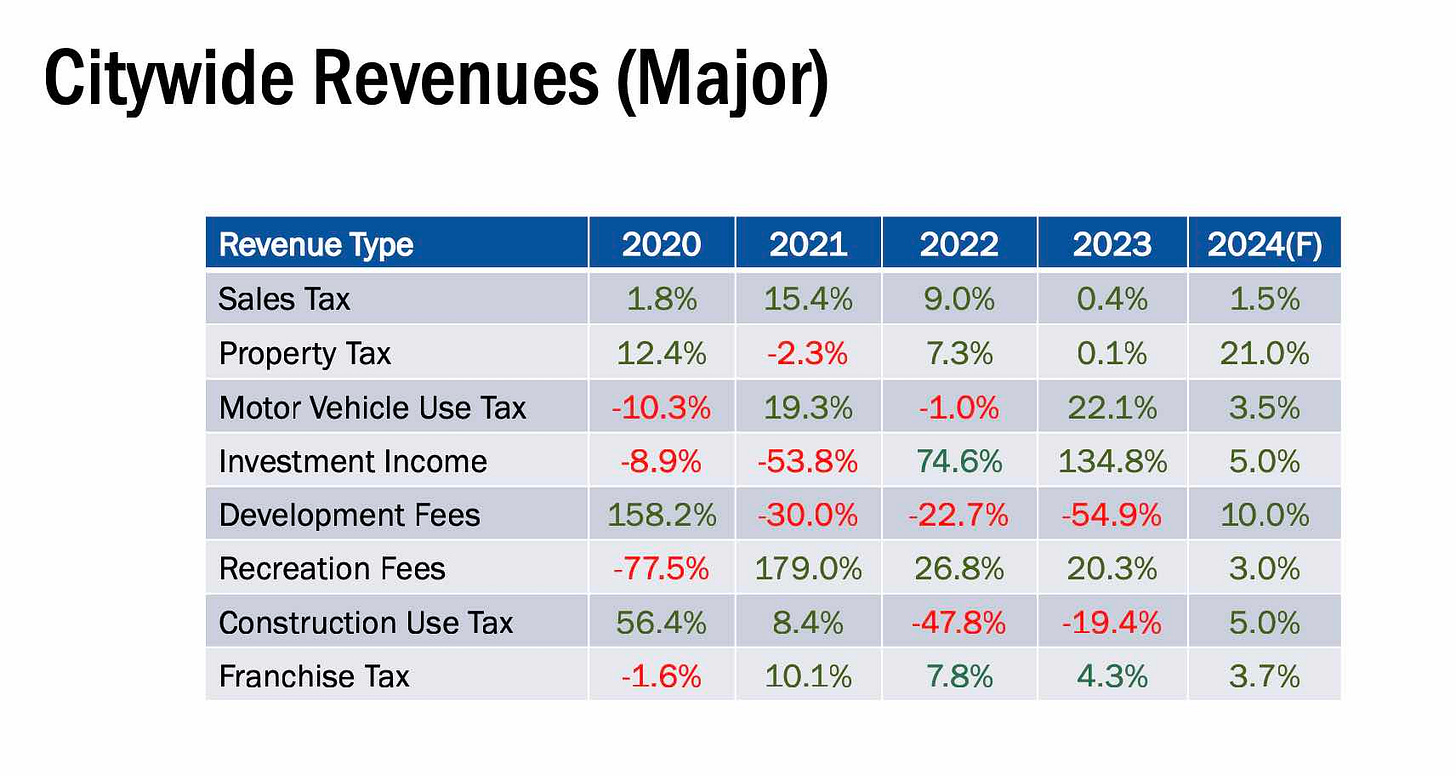

THE TOP TEN REVENUE SOURCES

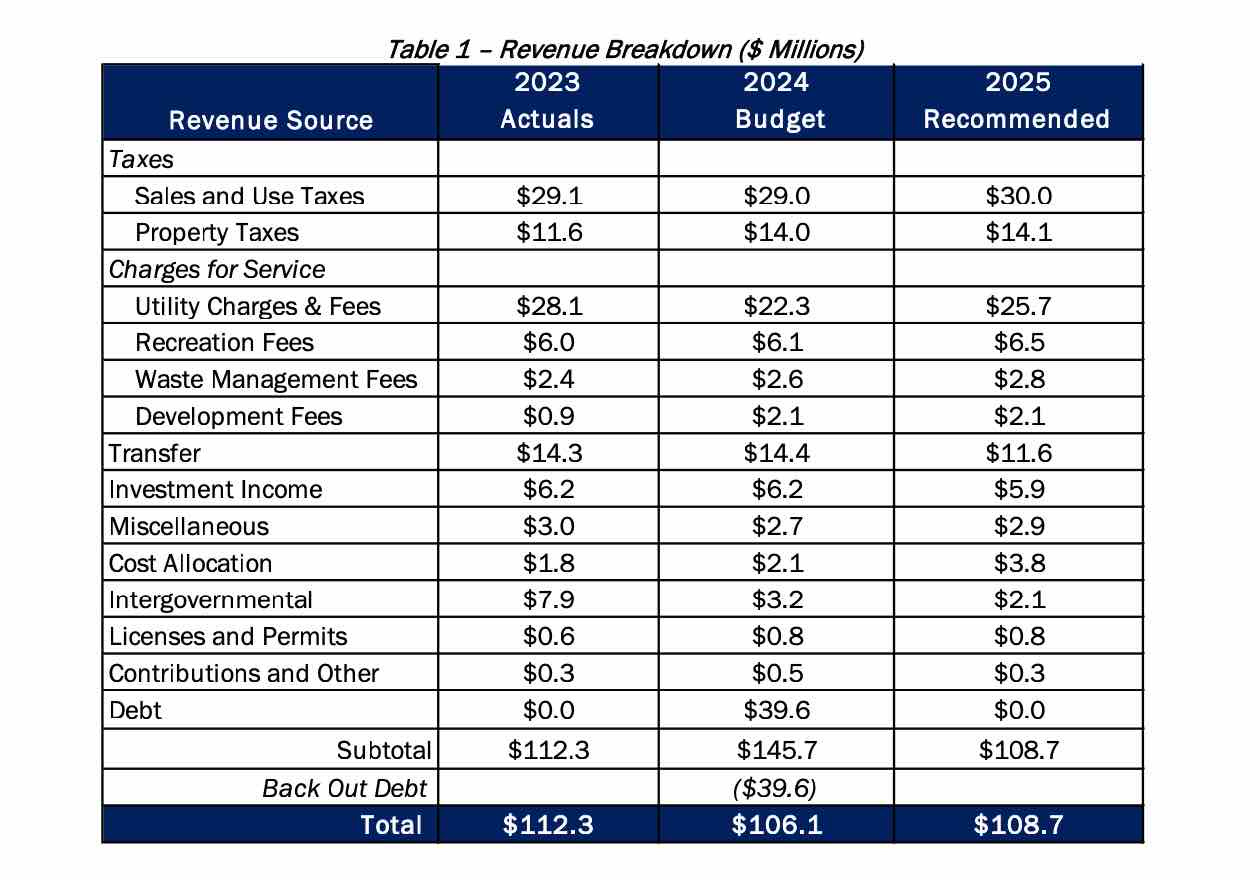

TOTAL REVENUE BREAKDOWN

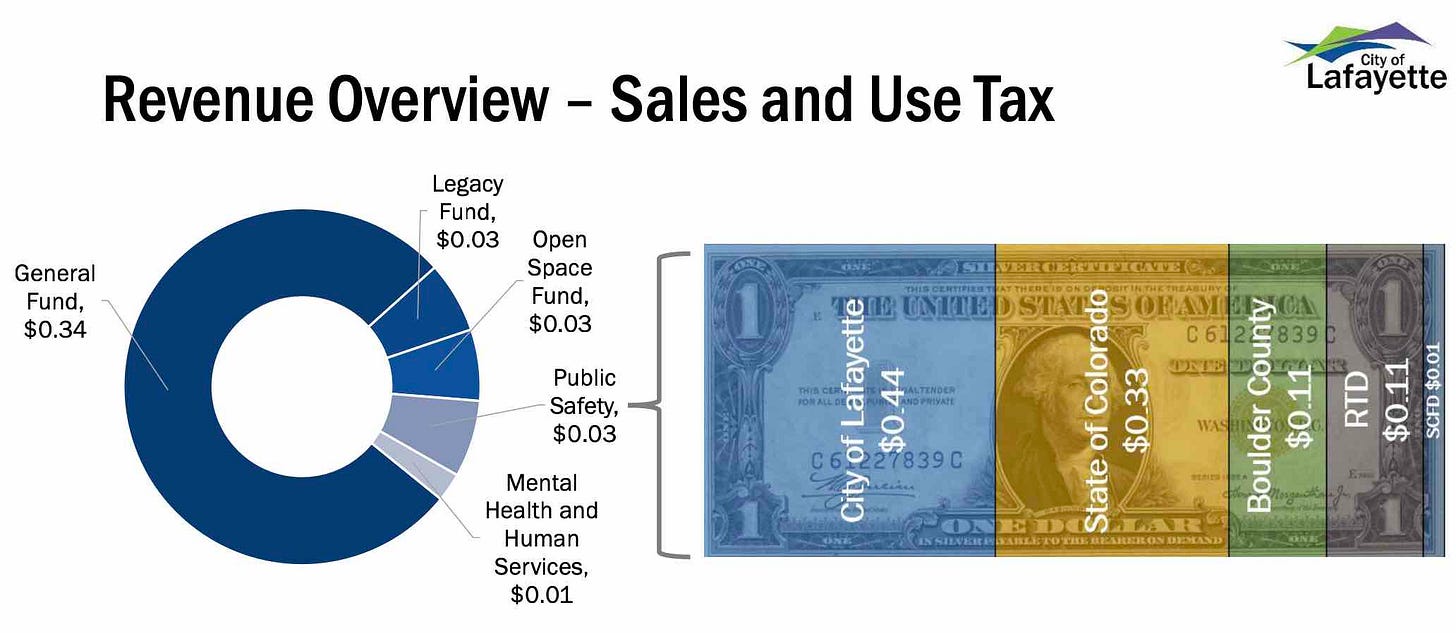

THE BREAKDOWN OF SALES TAXES

This graphic shows where each penny goes. Sales tax in Lafayette is 9.055%, and Lafayette’s portion is 3.87% or 44 cents. A slight clarification of the pie chart text is needed. The Legacy Fund contains funds raised from our voter-approved Legacy Tax for open space. It is earmarked for the acquisition and maintenance of open spaces. The fund marked as Open Space Fund is the Parks, Open Space, and Trails Fund, or the POST tax (another voter-approved tax), the name is self-explanatory. The General Fund is the big checkbook used for many of our city services.

HOW YOUR SPENDING AFFECTS THE 2025 PROJECTIONS FOR REVENUE

Lafayette collects sales taxes on purchases made in the city and from online retailers. If you’re shopping in town, on Amazon, or your Auntie Jean is here from Nebraska and dropping a chunk of change it’s all going into the above accounts.

Shopping in another town? Lafayette doesn’t get that 44 cents.

PROPERTY TAXES

Look! We only get 18 cents from a dollar and only 11 cents goes toward general operating. Debt service includes paying off the bonds for The Great Outdoors Waterpark and some water facility related bonds.

The state initiatives were withdrawn from the ballot in early September.

A NEW REVENUE SOURCE, THE END OF LURA

I wrote about the Lafayette Urban Renewal Authority in March this year. It’s a state-regulated board created in 1999 to address blight. The mechanism used to provide funding for the authority is called tax increment financing or TIF.

When the authority was created the property and sales taxes collected in the defined district were tallied and called the base. For the next 25 years (this ends in October this year hence the end of LURA) the money above the base went into the LURA bank account to be used within the district. The property tax base was adjusted every two years. You can see that if investments into the area lead to the collection of more sales and property taxes that then gives the authority more money to work with.

Once that TIF ends the money going into the LURA bank account now switches to the city’s general fund. In 2024 the projected revenue for LURA was $1.8 million. Cha-ching.

Stay tuned for Part 5B and how we spend these dollars!

Want to offer more support? Awesome!

Thanks again...clear as mud.

Thank you! Very helpful information. I appreciate your saying anything we spend in other cities Lafayette gets zero. I’ve mentioned this to my neighbors, many of whom shop at Kings on S Boulder because it’s a little closer. Hopefully they will shift to the new Kings (it’s further but shiny new). I know we are sharing revenue but it’s better than nothing, IMO.