A look at the capital projects survey results. Part two: funding.

Property or sales tax?

This is part two of my update on the potential 2025 ballot question regarding raising property or sales taxes to fund some capital projects. Projects under consideration are a remodel and expansion of the Bob Burger Recreation Center, an expansion and remodel of the Service Center, and a new City Hall.

In part one, I shared demographic information and respondents’ replies to questions about the city.

A look at the survey results. Part one: Your thoughts about the city

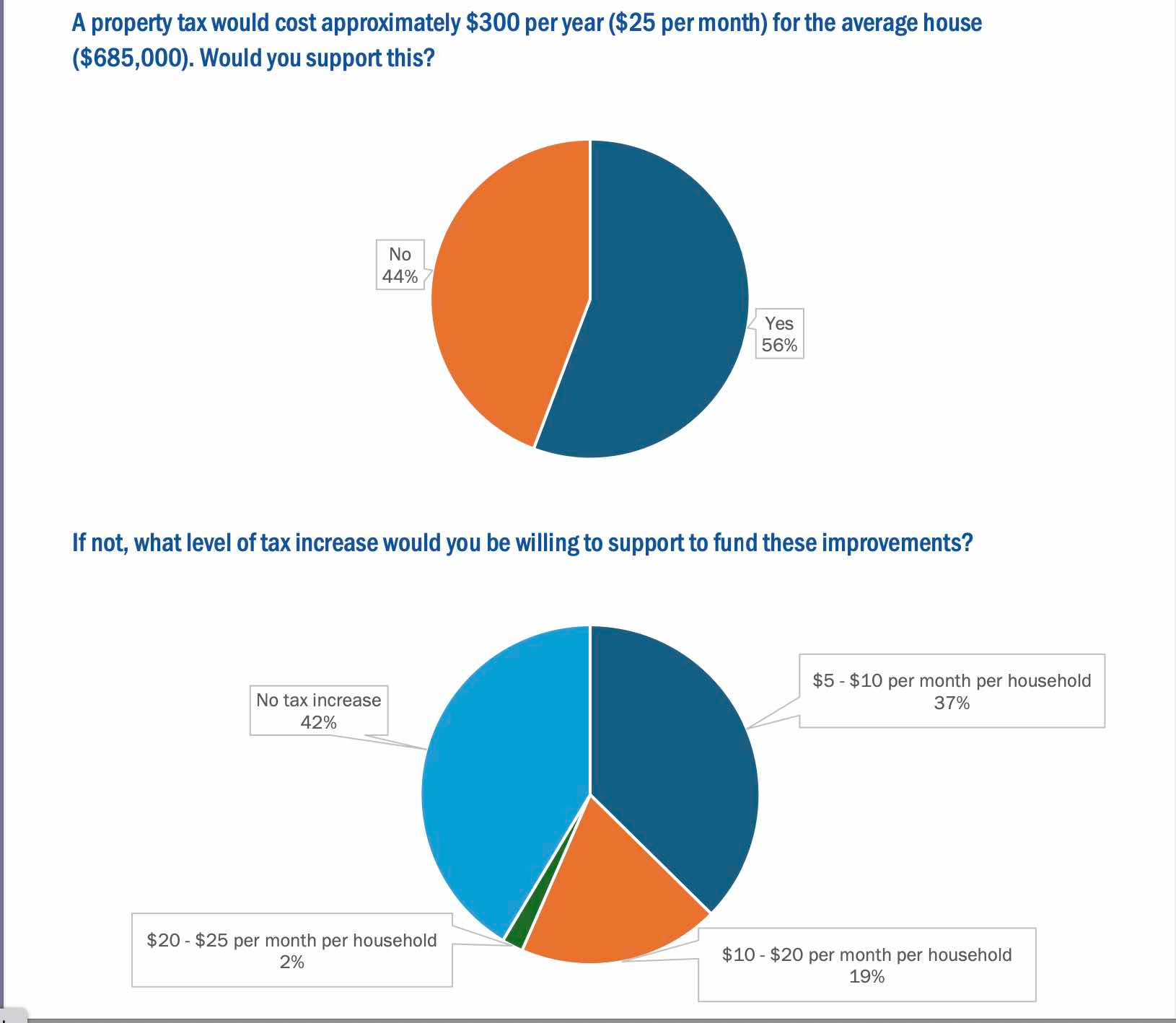

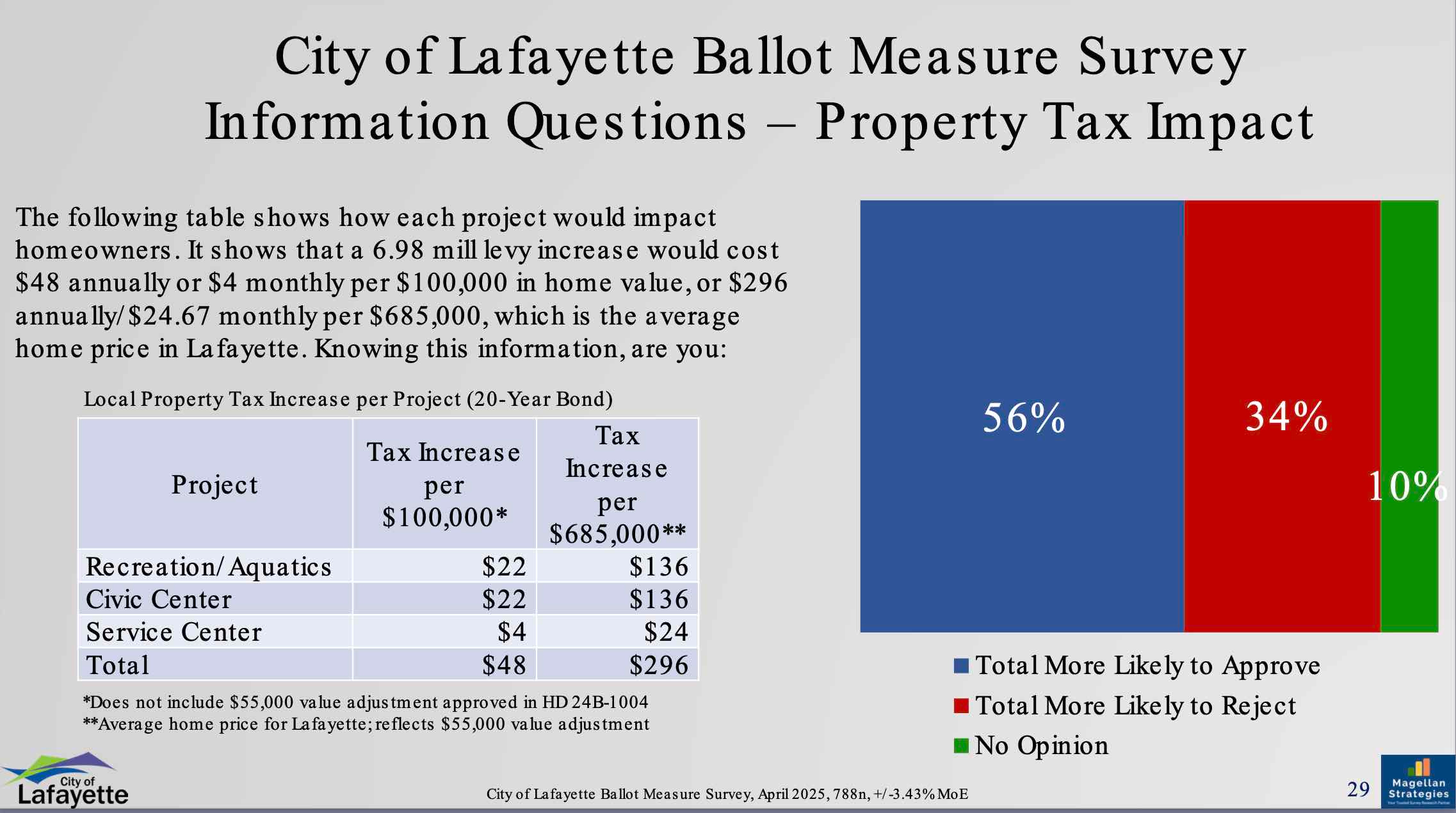

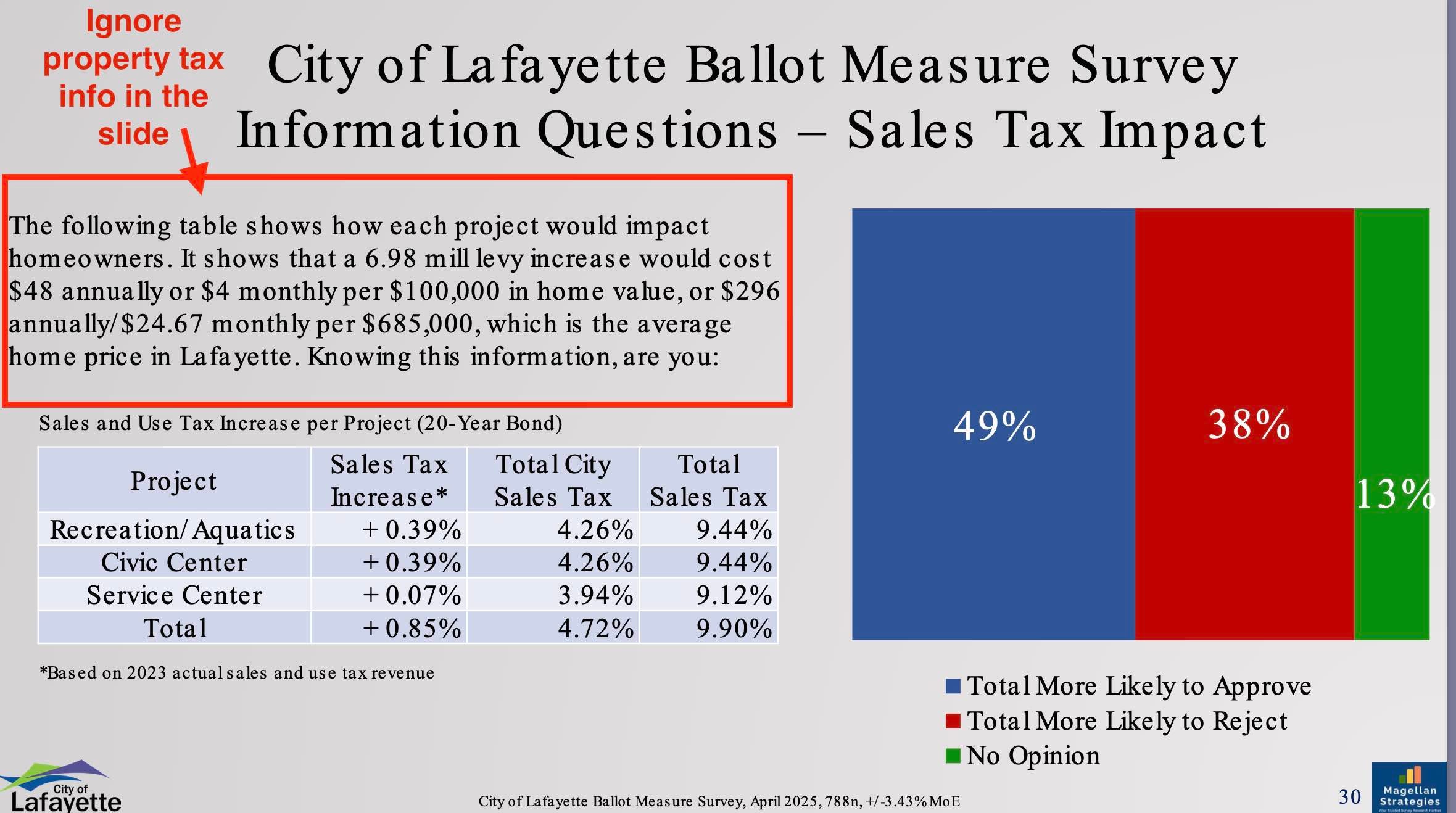

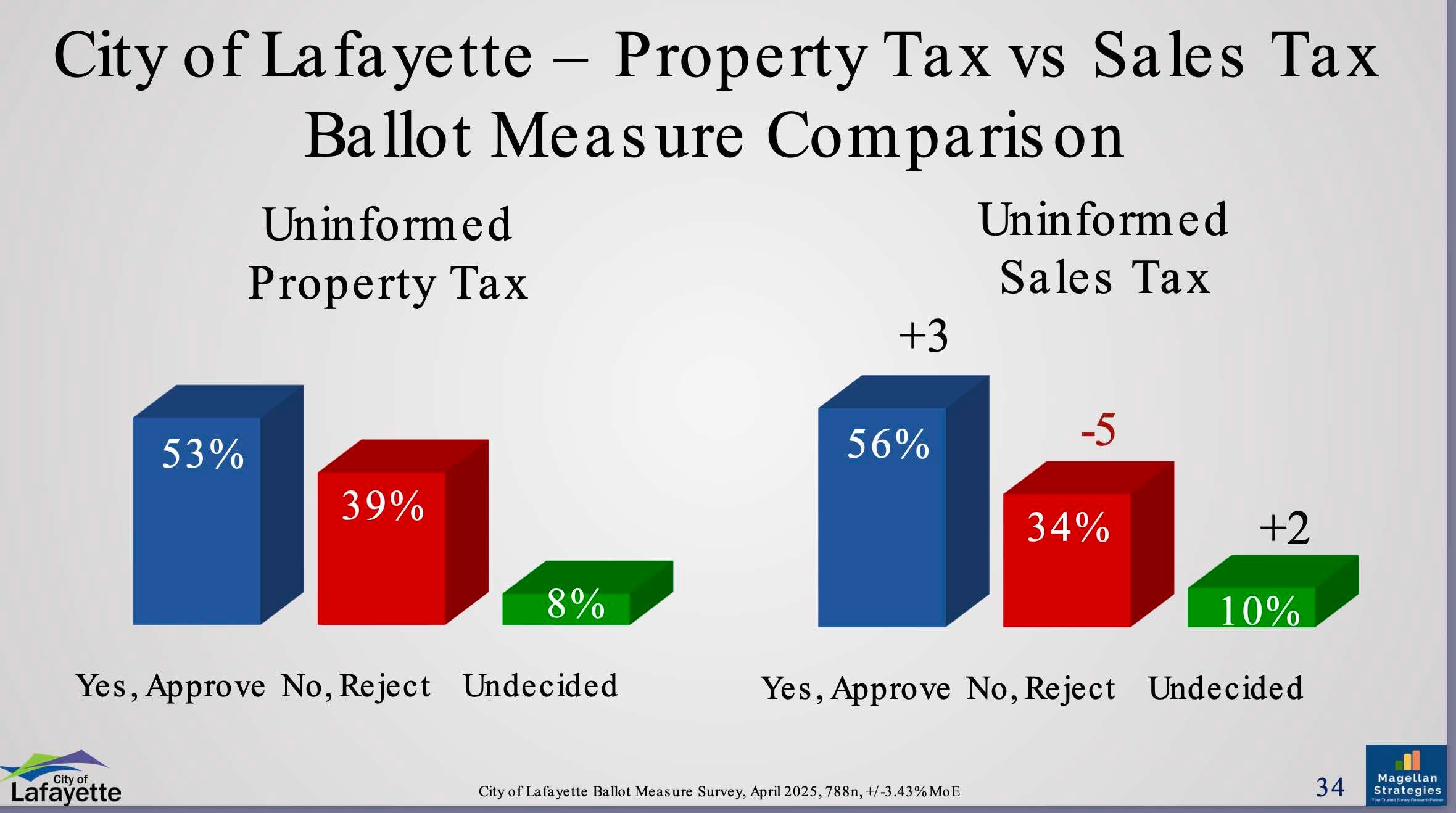

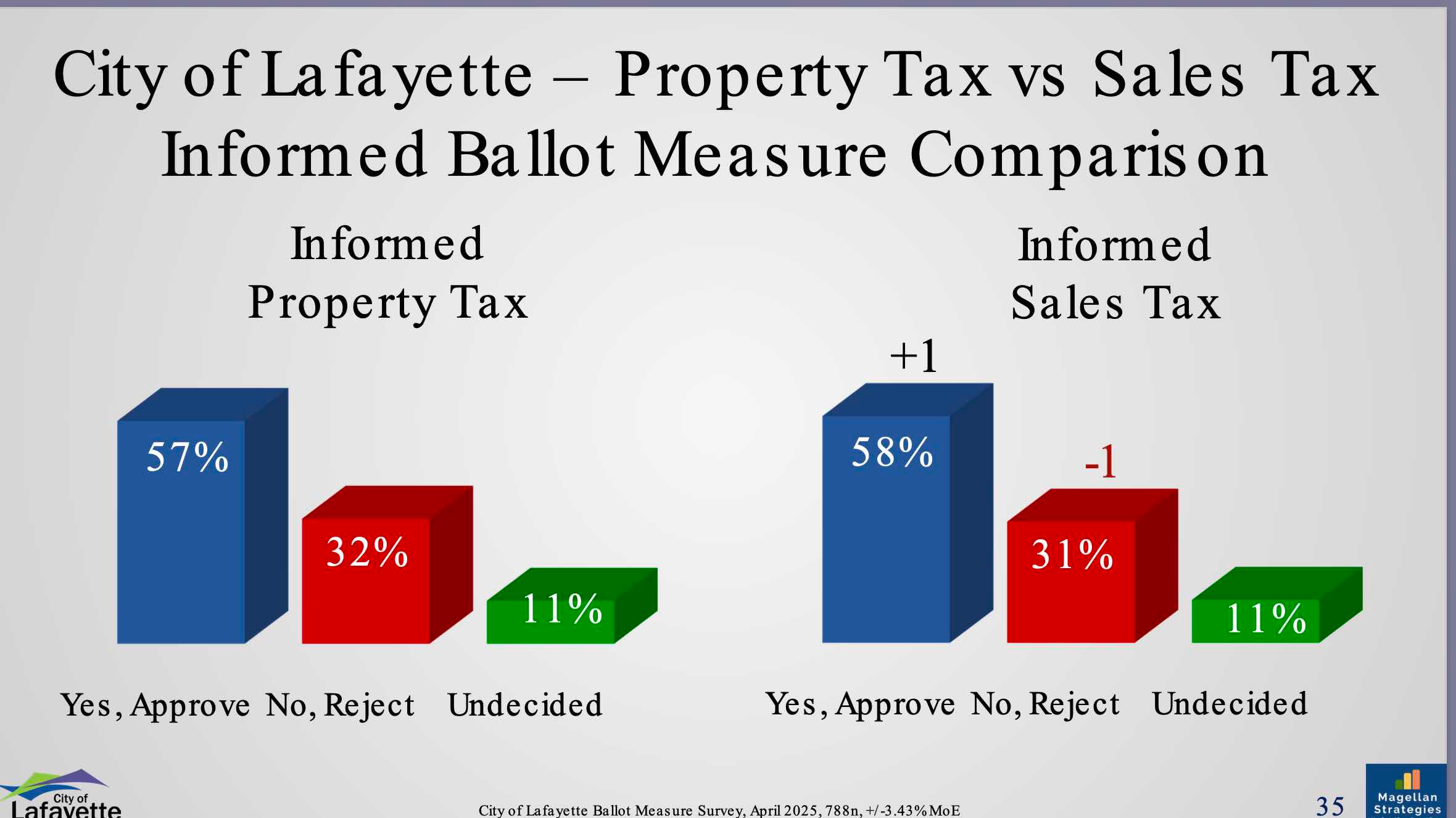

Now let’s look at responses to questions about increasing property taxes compared to sales taxes. Our sales tax is currently the highest in the region.

PROPERTY TAX OR SALES TAX?

Following the presentation of the survey results in their May workshop, the Council is considering a 20-year bond paid through a property tax increase. A final decision has not been made. The council will be discussing it during their June 24th workshop.

From the survey:

UNIFORMED VS INFORMED

The survey provided two versions of the potential ballot language: a sales tax increase and a property tax increase. Respondents were asked for their opinion. This is the uninformed group. They were then given information about the individual projects and asked again; this is the informed group.

Want to offer more support? Awesome!

I've said it before, but I'm going to say it again. These proposed tax increases seem small, but they are not in context. Almost a fifth of the residents of Lafayette are 60 years old or older. Many of them are on fixed incomes, Both property taxes and sales taxes are regressive -- particularly so for families on fixed incomes. That needs to be considered when looking at the last five years:

- inflation over the last five years in a cumulative 20%

- Water rates have gone up 20% in two consecutive years

Neither of those are going to go down, and they are meaningful numbers. Now we want to add a few hundred dollars to everyone's tax bill. The City Council is not being transparent here. By neglecting to put the increases in the context of past cost of living increases, it seems to be a conscious effort to mask the potential impact.

The service center patently needs to be expanded. The Rec Center aquatic facilities need to be fixed. I have been and remain opposed to a fancy new City Hall in the face of likely cuts in Federal grants and the (obvious to me) energy inefficient design of the new city hall with its two-story atrium that the Lafayette taxpayers will pay to heat and cool.

I use the Rec Center, but it is in competition with commercial facilities throughout the city and with the YMCA. Why is government competing with the private sector? Maybe Lafayette should open a grocery store (like the Mayor of Chicago wants to do for Chicago). Is that really different?

Repairs to city owned property should be planned for in our annual budgets not left to the "OMG, the XXX needs to be repaired. We have to raise taxes." That is poor planning. I grew up with and firmly believe in Proper Prior Planning Prevents P Poor Performance.

Finally, I have never seen a temporary tax increase that really went away. The City Council will find new shiny things to spend the money on after bonds are paid off. Guaranteed.

As always, thanks for your detailed summaries. I find it very interesting that the “undecided” in both groups increased after they were ‘informed’. As already discussed here, raises more concerns and questions.

The Council is in a tough place. In my experience maintenance doesn’t make it into most budgets (BVSD is an example). When things get bad they go to the voters to get a bond. It’s hard to budget for maintenance and I wish they would start doing that. Tough choices all around.