If you’ve read my post Following The Money - Part One: The Breakdown you should have a pretty good idea of how the money needed to run the city is compartmentalized. This report will focus on the big pot o’ money, the General Fund. I always feel like I should salute when this topic comes up. But I digress.

We know this is the fund that’s used to pay for a large portion of the city’s bills, but where does that money come from? Once more I’m going to use the city’s 186-page 2024 budget book. I’m also going to use some graphics City Administrator Doelling sent me when I started asking questions in preparation for writing these reports.

The budget book tells us there are over 100 different sources of revenue.

Number one.

Had you going there for a second didn’t I? It’s the main sources that are of interest here.

ARE PROPERTY TAXES THE NUMBER ONE REVENUE SOURCE?

I imagine a lot of folks think this is the main revenue source but that’s not the case. Take a look at this, it shows where the expected 2024 revenue will come from. See that taxes slice? 29%. That’s what I want us to look at. The budget book doesn’t break that section down the way I hoped but luckily the city administrator’s graphics do.

The predicted revenue for 2024 is $147.1 million. We can see the taxes in more detail in this graphic, we see sales and use taxes at 21% are ahead of property taxes at 8%. But this shows revenue in all the funds, and we want to look at the General Fund which accounts for a giant chunk of our spending. One more dig-deeper graphic to go.

Here’s that same property tax/sales tax breakdown but now only focused on the General Fund. (time to salute again) When we take out the money from the dedicated funds that I wrote about in part one and only look at the General Fund here’s what we see. 47% of the money in the main checking account comes from sales and use taxes. 24% from property taxes.

THE KING SOOPERS EFFECT

Our Chief Financial Officer (CFO) Devin Billingsley gave a revenue presentation at the City Council retreat in February. Mayor Pro-Tem Wong asked what kind of hit our finances will take when King Soopers moves to Nine Mile Corner in Erie and closes the Lafayette store. Here’s more info about the move and what might happen. The response was gasp-worthy. A 40% revenue hit. Gulp. That means a hit to our sales tax funded open space/parks, fire/police, and human services accounts too.

THE LAFAYETTE AND ERIE “LET’S SHARE” AGREEMENT

As you may know, we have an Intergovernmental Agreement (IGA) with Erie for a 50/50 split of sales tax revenue collected at their Nine Mile Corner retail center and, if developed, the Tebo property on the southwest corner of 287 and Arapahoe in Lafayette. Erie’s sales tax is 3.5%.

Our agreement with Erie covers the entire Nine Mile commercial area but as part of the deal we committed to help them pay off their debt on the development which won’t happen until 2038 (yes 2038, that is not a typo). For now, we will only be receiving our half of the King Soopers sales taxes but that’s as soon as the store opens. Erie will keep our portion of the remainder until the debt is paid. That 50/50 split will be for Erie taxes only, so it won’t include funds for our open space/parks, fire/police, and human services because those are Lafayette taxes.

During a somewhat historic meeting between Lafayette’s City Council and Erie’s Board of Trustees in 2022, Erie staff showed a revenue-sharing prediction for Lafayette of $28 million through 2040.

WHAT DOES OUR CFO THINK ABOUT THIS?

CFO Billingsley said if this conversation was happening 15 years ago we would have a worse outcome than today. He said we are in a pretty good spot now which helps us to absorb the move.

These comments stuck with me and a few days later I contacted him and asked if he could explain in more detail. What’s happened in the last 15 years to create more of a buffer for us?

I had a couple of ideas about new revenue but what else is there? Let’s take a look.

ONLINE SALES TAX COLLECTION: CHA-CHING!

In 2018, a South Dakota v. Wayfair court case changed online sales across the country. It allowed states to require companies with over 200 transactions or $100,000 in online sales to collect sales taxes even if they didn’t have a physical presence in the state. If you were shopping online before then you might remember you often didn’t pay sales taxes. That was good for the consumer but not for all the municipalities and states that count on sales tax revenue. Now most states require it.

And yes, when I asked staff for the breakdown of sales tax and property taxes going into the General Fund, I did ask if the sales tax was broken down between brick-and-mortar and online. This would be interesting to see. (I know, I know, I am a nerdy wonk). Not yet but they are working to make that happen.

So if you’re sitting on your couch shopping online like there’s no tomorrow you are still helping to run the city and contribute to those special funds for open space, police, fire, and human services that I detailed in part one. If you are shopping in a store in another city you are contributing to their sales tax base. Except for car sales, that’s another twist in the story, those taxes go to the home city of the buyer so a good reason not to have a car dealership in town.

CHANGES DOWNTOWN — GOODBYE TO THE LAFAYETTE URBAN RENEWAL AUTHORITY.

There could be more money coming to us from downtown. Changes are afoot. But because there is more to tell about this topic it’s going to get its own report, stay tuned for part three.

FROM CFO BILLINGSLEY

Here’s a list the CFO sent me “with Yelp style dollar signs for relative impact” that shows what’s happened to mute the effect of the King Soopers’ move.

Property tax strength - $$$

LURA TIF expiration − $$

Public Safety Tax - $$

Marketplace facilitator−$$$

Pad sites east/south of Walmart - $

Kohls - $

Lafayette Crossings - $

Commercial development off Cabrini Drive - $

Commercial at 95th and Arapahoe - $

Stay tuned for the LURA TIF report but I asked about a couple of the others on the list, here is CFO Billingsley’s explanation:

“Marketplace facilitator basically refers to the legislation places the burden on the facilitators of the world (think Amazon, Walmart online, etc.) to start collecting and remitting sales tax for products sold by third parties on their websites. And the dedicated public safety tax allowed for needed investment in public safety without creating additional pressures on the general fund.”

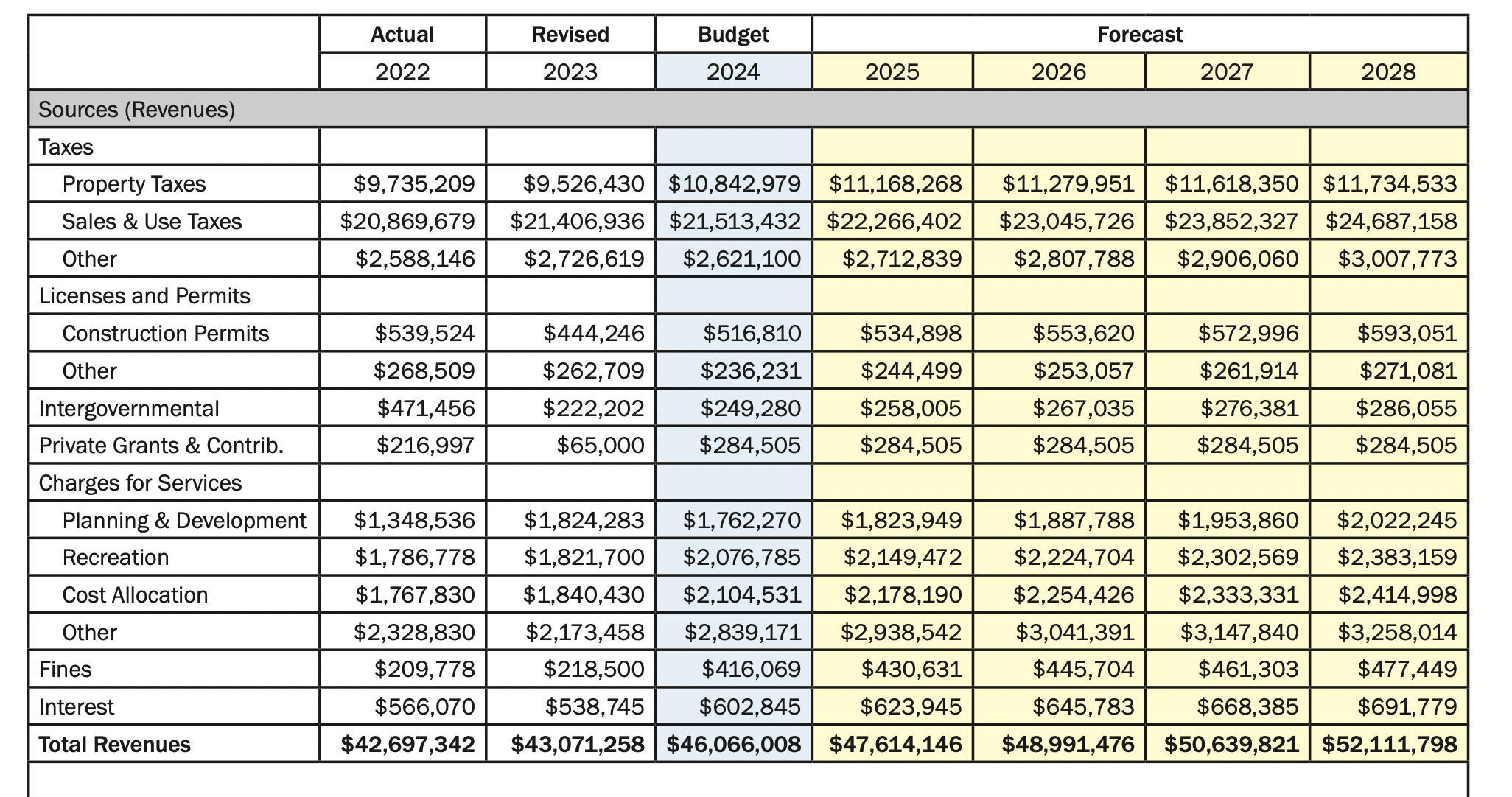

For those who love to see the numbers here are a couple of charts from the budget book.

REVENUE

EXPENSES

FUND BALANCE

I would like to see a comparison between the amount of Revenue lost by having Soopers move and the amount of money brought back by the agreement with Erie. Is the Soopers move a net gain or a net loss in revenue?

I'm still stunned at the idea that different municipalities can charge different sales tax rates.

Thanks Karen for a detailed and informative report. I'm happy to hear that the city, especially Dave Billingsley, was so cooperative and transparent with you. That's a positive sign 👍